RE-ENGINEERING

THE BANK

By Leonardo Delizo, PhD, MSBA

Improved customer service is the main focus of many reengineering programs in Asia. According to Banthoon Lansam, re-engineering is about changing the knowledge and thinking of each individual employee and providing them with the technology to better serve the customer. Companies must empower employees at all levels to deal directly with the customer. Therefore, empowerment and the responsibility devolvement relieve management of much control work, and makes management of telework less different form management on site staff.

Re-engineering was an urgent issue for banks in the 1990s. The reason process re-engineering is so critical is that even though on the surface it appears banks are continuing to grow, in fact they have experienced real share reductions in the delivery of financial services to householder and businesses. This decline points to the need for significant change.

Redesigning complex processes from scratch can be incredibly traumatic for an organization and financial commitment is heavy. A company can expect to pay much money for a re-engineering consultant. Millions or billions of pesos is spent for a period of two to four years in implementing automation in the company.

In traditional organizations of banks, the bank processes are effectively invisible and essentially mismanaged. The traditional hierarchical and inward looking management philosophy has to be replaced by an obsessive commitment to adding value for customers. This forces owners to look at the business from the outside to the inside and to concentrate on the end- to-end management of the processes which serve their customers.

Donald A. Marchand enumerated the four levels of re-engineering. “The first level concerns specific task improvements. Many companies are engaged in task-oriented process improvements as a key aspect of their TQM or just-in-time initiatives. The second level focuses on the redesign of business processes in an entire department. The third level concerns the redesign of cross-functional processes. Companies of all kinds are attempting to flatten their organizations, redesign functional responsibilities, and change from a departmentalized to a process-focused culture. The fourth level of re-engineering involves redesigning the company and its business. As a company progresses from levels 1 and 2 (tasks and functional focus) to levels 3 and 4 (cross-functional and business redesign), the risk and complexity associated with re-engineering increase significantly, and the likelihood of disappointing projects-efficiency and productivity-are easy to measure. The gains expected from cross-functional and business redesign efforts – increased market share, profitability, customer responsiveness, and flexibility – are more difficult to achieve. In addition, achieving levels 3 and 4 involves a five-to-seven years process.

Expert in quality and planning improvement fields Edwin T, Crego Jr. and Peter D. Schiffrin, in their highly regarded book Customer Centered Re-engineering defines re-engineering as “a methodology for rethinking and redesigning the organization’s core processes from ground zero to make them significantly more effective and efficient. Sounds simple enough, but re-engineering is actually a serious undertaking that, as experiences tell will require not only the resources of the organization but also its heart and soul.

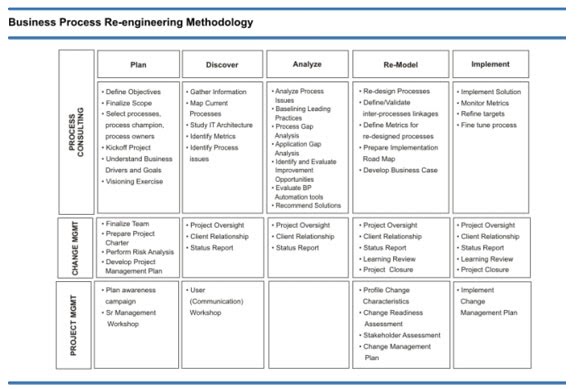

According to Covert, the task experts agree upon to successfully perform Business Process Re-engineering can be grouped into seven steps or phases. These phases are: Phase 1: Begin organizational change; Phase 2: Build the re-engineering organization; Phase 3: Identify BPR opportunities; Phase 4: Understand the existing process; Phase 5: Re-engineer the process; Phase 6: Blueprint the new business system and Phase 7: Perform the transformation. According to him, all successful Business Process Re-engineering begin with the critical requirement of communication throughout the organization.

As a result of the conducted study, the initiative to Business Process Re-engineering of private central commercial banks is seen as externally driven—customers, competitors, cost, technology shift, shareholders - the greatest challenge to its implementation is identified as organizational. Majority of them re-engineered accounting, loans, and credit department first because these departments have ability to produce increase revenues, minimize cost and maximize profit in the financial statements. Developing an active customer information system to better segment customer market, identifying and pro-actively serve their needs was the top reason for the re-engineering of these private central commercial banks. Majority implemented level 2 of re-engineering which concerns the redesigning of business process in an entire department. Thus, redesigning process and automations, as value added constituents, are seen as creating more value for less cost. Thus, automation and redesign processes were both implemented in the departments of the commercial banks. Different private central commercial bank departments experience different output of the re-engineered business as to the degree of effectiveness. It is critical to look at a bank as a whole to re-engineer it effectively, and to capitalize on the cross-bank synergies from redesign of individual process. Banks significantly experience different degrees of problem, with regards to the constraints, faced in implementing re-engineering program in their different departments. Problems occur in different degrees if top management have no effective way of communicating to the employees especially the rank and files on how to tackle the need for change. It clearly indicates to employees that the restructuring is a one-time process, not the first of successive “dips” into cost reduction following management’s “knee-jerk” reaction to short-terms earnings fluctuations. The factors such as the financial support from the head office, top management’s moral support, flexibility of personnel, and the knowledge in re-engineering, all have equal weight of importance in conducting re-engineering program whatever departments to be re-engineered. In summary, re-engineering program often involves abandoning traditional hierarchical best practice and replacing them with more self-managed people who not only perform their own functions well but also connect effectively with other functions.

It has been recommended that the private central commercial bank desperately need to adapt types of re-engineering program at the same time such as redesigning processes and automating manual processes. It is recommended that using information technologies are necessary to support reengineering program. The following technologies recommended to be adapted are namely: knowledge-based system; document image processing, workflow, and groupware; electronic data interchange; distributes system and client-server architecture. These central commercial banks and other business establishments should used knowledge-based system as the major tool program. In addition they must continue to face strong pressure update their cash management service technology in the years ahead by updating their cash – management service delivery methods to minimize cost and to provide services at a price that beats the growing competition in this field. Banks and other business establishments should continue to scrutinize the process carefully to be redesigned and study what departments could gain the benefits throughout the system without producing a manual function or any human intervention. In redesigning processes it may combine several jobs, empower employees, make steps in natural order, make processes in multiple forms, perform work where it make sense, reduce checks and controls, make a simple point or centralize contact, simplify products, centralize customer service. Other business firms are advised likewise. The different technologies designed, adapted and implemented can be combined and configured to form systems products that are useful to customers, employees and consumers. It is also advised that there are things to consider in automating systems. These are compatibility - i.e. compatibility with the variety of systems operating the business, compatibility with the systems of other companies and compatibility over time; cost - i.e. initial cost, cost of installation, cost of maintenance; flexibility and capacity of the machines and equipment; and trade-in allowances. To make the re-engineering program truly effective, it is advised that the top management must strictly follow the four levels of re-engineering program. To minimize constraints encountered, the following are advised: develop a good strategic stakeholders management communication system starting from the top management, stockholders/shareholders, employees and to customers to facilitate easy implementation and allowing employees from all levels to participate in this program to commit each employee to change, thereby significantly increasing the success rate of the effort.

Re-engineering was an urgent issue for banks in the 1990s. The reason process re-engineering is so critical is that even though on the surface it appears banks are continuing to grow, in fact they have experienced real share reductions in the delivery of financial services to householder and businesses. This decline points to the need for significant change.

Redesigning complex processes from scratch can be incredibly traumatic for an organization and financial commitment is heavy. A company can expect to pay much money for a re-engineering consultant. Millions or billions of pesos is spent for a period of two to four years in implementing automation in the company.

In traditional organizations of banks, the bank processes are effectively invisible and essentially mismanaged. The traditional hierarchical and inward looking management philosophy has to be replaced by an obsessive commitment to adding value for customers. This forces owners to look at the business from the outside to the inside and to concentrate on the end- to-end management of the processes which serve their customers.

Donald A. Marchand enumerated the four levels of re-engineering. “The first level concerns specific task improvements. Many companies are engaged in task-oriented process improvements as a key aspect of their TQM or just-in-time initiatives. The second level focuses on the redesign of business processes in an entire department. The third level concerns the redesign of cross-functional processes. Companies of all kinds are attempting to flatten their organizations, redesign functional responsibilities, and change from a departmentalized to a process-focused culture. The fourth level of re-engineering involves redesigning the company and its business. As a company progresses from levels 1 and 2 (tasks and functional focus) to levels 3 and 4 (cross-functional and business redesign), the risk and complexity associated with re-engineering increase significantly, and the likelihood of disappointing projects-efficiency and productivity-are easy to measure. The gains expected from cross-functional and business redesign efforts – increased market share, profitability, customer responsiveness, and flexibility – are more difficult to achieve. In addition, achieving levels 3 and 4 involves a five-to-seven years process.

Expert in quality and planning improvement fields Edwin T, Crego Jr. and Peter D. Schiffrin, in their highly regarded book Customer Centered Re-engineering defines re-engineering as “a methodology for rethinking and redesigning the organization’s core processes from ground zero to make them significantly more effective and efficient. Sounds simple enough, but re-engineering is actually a serious undertaking that, as experiences tell will require not only the resources of the organization but also its heart and soul.

According to Covert, the task experts agree upon to successfully perform Business Process Re-engineering can be grouped into seven steps or phases. These phases are: Phase 1: Begin organizational change; Phase 2: Build the re-engineering organization; Phase 3: Identify BPR opportunities; Phase 4: Understand the existing process; Phase 5: Re-engineer the process; Phase 6: Blueprint the new business system and Phase 7: Perform the transformation. According to him, all successful Business Process Re-engineering begin with the critical requirement of communication throughout the organization.

As a result of the conducted study, the initiative to Business Process Re-engineering of private central commercial banks is seen as externally driven—customers, competitors, cost, technology shift, shareholders - the greatest challenge to its implementation is identified as organizational. Majority of them re-engineered accounting, loans, and credit department first because these departments have ability to produce increase revenues, minimize cost and maximize profit in the financial statements. Developing an active customer information system to better segment customer market, identifying and pro-actively serve their needs was the top reason for the re-engineering of these private central commercial banks. Majority implemented level 2 of re-engineering which concerns the redesigning of business process in an entire department. Thus, redesigning process and automations, as value added constituents, are seen as creating more value for less cost. Thus, automation and redesign processes were both implemented in the departments of the commercial banks. Different private central commercial bank departments experience different output of the re-engineered business as to the degree of effectiveness. It is critical to look at a bank as a whole to re-engineer it effectively, and to capitalize on the cross-bank synergies from redesign of individual process. Banks significantly experience different degrees of problem, with regards to the constraints, faced in implementing re-engineering program in their different departments. Problems occur in different degrees if top management have no effective way of communicating to the employees especially the rank and files on how to tackle the need for change. It clearly indicates to employees that the restructuring is a one-time process, not the first of successive “dips” into cost reduction following management’s “knee-jerk” reaction to short-terms earnings fluctuations. The factors such as the financial support from the head office, top management’s moral support, flexibility of personnel, and the knowledge in re-engineering, all have equal weight of importance in conducting re-engineering program whatever departments to be re-engineered. In summary, re-engineering program often involves abandoning traditional hierarchical best practice and replacing them with more self-managed people who not only perform their own functions well but also connect effectively with other functions.

It has been recommended that the private central commercial bank desperately need to adapt types of re-engineering program at the same time such as redesigning processes and automating manual processes. It is recommended that using information technologies are necessary to support reengineering program. The following technologies recommended to be adapted are namely: knowledge-based system; document image processing, workflow, and groupware; electronic data interchange; distributes system and client-server architecture. These central commercial banks and other business establishments should used knowledge-based system as the major tool program. In addition they must continue to face strong pressure update their cash management service technology in the years ahead by updating their cash – management service delivery methods to minimize cost and to provide services at a price that beats the growing competition in this field. Banks and other business establishments should continue to scrutinize the process carefully to be redesigned and study what departments could gain the benefits throughout the system without producing a manual function or any human intervention. In redesigning processes it may combine several jobs, empower employees, make steps in natural order, make processes in multiple forms, perform work where it make sense, reduce checks and controls, make a simple point or centralize contact, simplify products, centralize customer service. Other business firms are advised likewise. The different technologies designed, adapted and implemented can be combined and configured to form systems products that are useful to customers, employees and consumers. It is also advised that there are things to consider in automating systems. These are compatibility - i.e. compatibility with the variety of systems operating the business, compatibility with the systems of other companies and compatibility over time; cost - i.e. initial cost, cost of installation, cost of maintenance; flexibility and capacity of the machines and equipment; and trade-in allowances. To make the re-engineering program truly effective, it is advised that the top management must strictly follow the four levels of re-engineering program. To minimize constraints encountered, the following are advised: develop a good strategic stakeholders management communication system starting from the top management, stockholders/shareholders, employees and to customers to facilitate easy implementation and allowing employees from all levels to participate in this program to commit each employee to change, thereby significantly increasing the success rate of the effort.

Source: The Re-engineering Program Among Private Central Commercial Banks. Leonardo I. Delizo. 1997